If you’re building or managing a fintech startup that serves small and medium-sized businesses (SMBs), one thing hasn’t changed: your growth depends on getting in front of the right people at the right time.

And while there are a lot of marketing tactics out there, search is still one of the most reliable ways to bring in leads, especially if you’re playing the long game.

It doesn’t require chasing trends or relying on virality. Instead, it works by answering real user questions, earning trust over time, and showing up at key decision moments, especially for time-strapped business owners comparing options.

In this article, I’ll walk you through 5 types of content that are proven to work for B2B fintech companies looking to grow their lead pipeline. These include:

- Case studies that build trust

- Educational blog content that simplifies complex topics

- Bottom-of-funnel content that drives conversions

- Thought leadership that humanizes your brand

- Lead magnets that turn passive readers into qualified leads

You’ll also see examples from brands like Wise, plus industry-backed data on why these content types work (and what to do if you’re worried about AI search disrupting SEO).

But first, let’s address the most common concern I hear from fintech founders and marketers.

Is SEO Still Worth It in 2025?

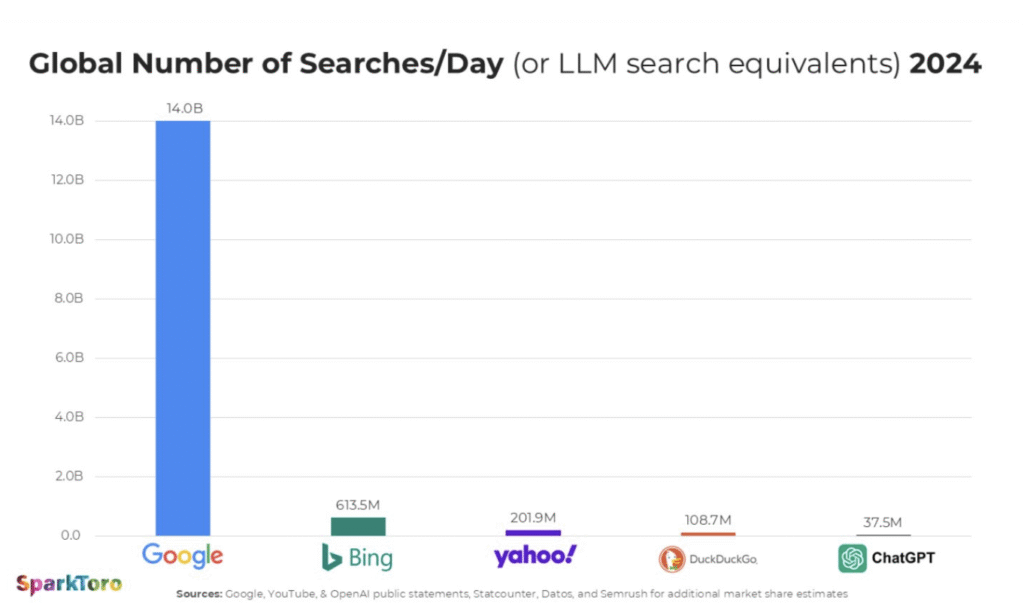

With the rise of ChatGPT, Perplexity, and Google’s AI Overviews, it’s easy to assume that traditional search is on its way out.

But that couldn’t be further from the truth.

In reality, search is evolving, and the companies that adapt are winning. Why? Because even with AI in the mix, people still rely on Google as their first stop when they have a problem to solve or a purchase decision to make.

In fact, Google gets around 373 times more searches than ChatGPT, which tells you everything you need to know: traditional search still dominates when it comes to discovering and vetting new solutions.

What’s more, 70% of the results shown by AI tools like ChatGPT and Perplexity still come from the top 10 Google results. In other words, if you’re ranking on Google, you’re ranking on AI too.

The better your content and domain authority, the better your chances of showing up everywhere — Google, AI summaries, and even voice search. So, no, SEO isn’t dead. It’s becoming more valuable. The key is knowing what kind of content to create and how to do it strategically.

Let’s break down the five content types fintechs should double down on if you want to build real traction in 2025.

5 Content Types That Drive Growth for Fintechs in 2025

1. Case Studies

Fintech is a high-trust industry. People are putting their money, and sometimes their entire business, in your hands. So before they book a demo or click “Sign Up,” they want one thing: proof.

That’s where case studies come in.

The best case studies do three things:

- Show tangible results

- Include direct quotes from real users

- Focus on transformation, not just features

A good case study becomes a high-converting asset you can reuse across blog posts, landing pages, pitch decks, and even sales calls.

>>> READ MORE: CASE STUDY: How Content Helped Launch a Creator Community and Generate Over $5,000 in 90 Days

2. Educational Blog Posts

Fintech can be intimidating, especially for small business owners who aren’t financial pros. Between the jargon, compliance requirements, and unfamiliar tools, it’s easy for users to feel overwhelmed. Statista reports that nearly 63% of users see a lack of trust as the biggest barrier to adopting digital financial tools.

That’s exactly why educational content is so effective. It closes the knowledge gap and the trust gap. And the numbers back it up: fintech blogs that publish consistent, data-backed content generate 67% more qualified leads than those that don’t.

So what should you write about? Start with the real problems your users are trying to solve. Use simple keyword research tools like Google’s autocomplete, Ubersuggest, Semrush, or Answer the Public to see what people are searching for. Even better, talk to your customers. Ask your sales or support team what questions come up the most.

Then turn those insights into blog posts, and use your product as part of the solution. Explain the concept, walk through the challenge, and show how your product helps make it easier, faster, or safer.

Keep the language simple. Use real-world examples. Add visuals, screenshots, or quick explainers where needed.

When someone finishes your blog post and feels like they finally get it (and sees how your product can help), they’re one step closer to signing up.

3. BOFU Content

Bottom-of-Funnel (BOFU) content is designed for users who are already deep in the decision-making process. They’re not just browsing, they’re comparing tools, reading reviews, and looking for the best solution to a specific problem.

Your job is to show up when they’re ready to choose.

Instead of targeting broad awareness keywords, focus on searches that signal purchase intent. Wise is a great example of this in action. They rank for highly specific, bottom-of-funnel keywords like:

- Send money from the UK to India

- Compare Revolut vs. Wise

- How to open a bank account in Germany as a foreigner, etc

Other strong BOFU keyword examples for fintech:

- “Best [product category] for [target audience or region]”

- “Alternative to [competitor] for [specific use case]”

- “[Tool A] vs [Tool B]” comparison searches

- “[Product] pricing [location]”

- “Alternative to [competitor]”

If your page answers their question clearly and helps them act fast, you’ve already won the lead.

4. Thought Leadership & Founder Stories

This one’s often overlooked, but it works.

As a founder, remember this: people buy from people. Especially in fintech, where trust is fragile and buyers want to know who’s behind the product.

That’s why founder-led content is so powerful. It’s personal, relatable, and builds credibility. Share what you’ve learned. Talk about the problem that pushed you to build the product. Be honest about what you’d do differently if you were starting again.

It doesn’t need to be overly polished, just real.

And the best part? Founder stories are easy to repurpose across platforms. One strong story can become:

- A carousel post

- A LinkedIn article

- A podcast topic, etc

5. Lead Magnets

Sometimes, people aren’t ready to buy yet, but that doesn’t mean they’re not interested.

This is where lead magnets come in. You offer something useful, and in return, they give you their email. Simple.

For fintechs, great lead magnets look like:

- A checklist

- Calculators

- A trends report

If it solves a small but real problem, people will download it.

Pro tip: Pair your lead magnet with a relevant blog post so that traffic finds it organically. And with the right follow-up, that one download could easily become a paying customer.

>>> READ MORE: How I Build Winning LinkedIn Content Strategies in 15 Steps

Final Thoughts

SEO isn’t dead, it’s evolving.

Yes, AI is changing how people search. But the principles are the same: clear, useful content wins.

If you’re in fintech and you want to generate leads that close, focus on content that educates, proves, and builds trust.

Work With Me

I help fintechs generate a 3–7× ROI within 3-6 months using content that’s built to convert.

If you’re looking to:

- Grow your inbound pipeline

- Educate and earn trust

- Turn your content into a real asset…

Let’s talk. Reach me on LinkedIn or send an email to chidinma.content@gmail.com for next steps.

Leave a Comment